Social Collaborative Business Ventures

Sliderocket was used to create this slide

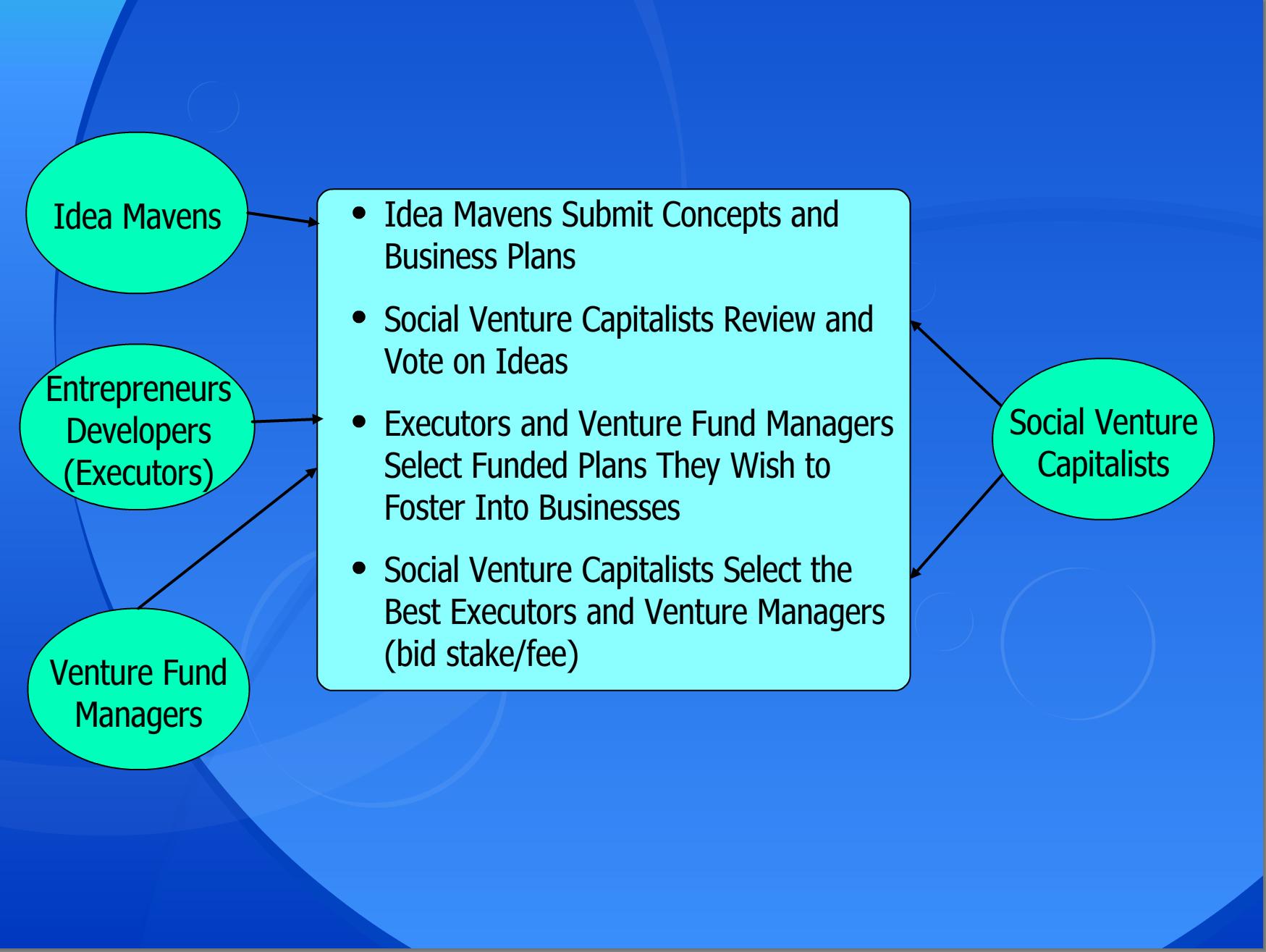

This is a follow on to an earlier concept, Crowd Sourced Venture Capitalism. The key is to establish a collaboration of entrepreneurship where many people can get involved and own various levels of the process of bringing a business concept to life. Ultimately the survival of a business is dependent on the team that executes. It is this understanding that has fostered a more elaborate plan than simple crowd sourced investment.

The concept is founded upon a four tier architecture, with nonexclusive subgroups:

- Idea Mavens

- Social Venture Investors (Crowd Sourced)

- Entrepreneurs or Developers depending on the nature of the concept

- Venture Fund Managers to Oversee projects

Idea Mavens

This role is characterized by folks who come up with ideas behind new business areas. Not only are they responsible for coming up with ideas, but must have an effective pitch with a well developed plan for the execution of that business concept. The crowd sourced venture investors are the ultimate authority on which ventures are funded and which ideas are abandoned.

Social Venture Investors

This group represents the group of people that have the spirit and desire of angel investors or venture capitalists, but much less liquid capital to invest or risk in a single startup. Their level of investment is small individually ($5-10k) but in aggregate they could represent billions of potential of investment dollars.

Entrepreneurs, Developers, The Business Executors

These serial entrepreneurs represent the primary caretakers of the business ideas developed and selected by the social venture investors. They are selected by the social venture investors and matched with an business/project that they have chosen to champion.

Venture Fund Managers

I described these important folks in my earlier post, but any good venture firm could fulfill this need.

The system will require a complete track record of venture firms with representation of their current strategies and holdings. Arguably, the greatest value of venture firms is not the cash they provide, but the powerful networking and many years of practical business experience they leverage for the success of any of their portfolio companies. Leaders in the field of startups Fred Wilson, NYC venture capitalist icon and Paul Graham, Y Combinator early investment hub leader , freely share their greatest lessons learned. The business of picking great startups isn’t magic, it’s a complex but practical problem space and is rooted in the philosophy of industry change, or disruption and investing in several startup groups. In my layman’s understanding, what it boils down to is choosing and cultivating both leaders and teams with the right mindsets and strategies.

Here's a short video where I talk about the concept:

*Post Updated thanks to the Vladimir Vukicevic's comment on the missing piece of the puzzle, the venture fund manager.*

Related articles by Zemanta

- Crowd Sourced Venture Capitalism (victusspiritus.com)

- Additional value of the funder (growvc.com)

- Startups: Top 10 Funding Sources (startupprofessionals.com)

- Shortage in early stage funding? (vator.tv)

- Angel Funding Waiting for the World to Change (myventurepad.com)

- Y Combinator's Paul Graham Wants To Mass Produce Start-ups (huffingtonpost.com)

- Do You Really Even Need VC? (cloudave.com)