The Slingshot

The slingshot requires that the startup position itself between two or more market leaders. The larger companies provide products adjacent to the problem your startup is solving, but compliment each other perfectly.

Imagine Facebook building a core service that relies heavily on Google? Bigger businesses strive to gain leverage on competitors, not to put themselves in a vulnerable position. A business weakness for bigger companies is an ideal blending of tools for your startup. Startups can cross all company lines to provide maximum customer satisfaction at the lowest cost. As large companies struggle to optimize and dominate market share, the startup utilizes partnerships to rapidly accelerate it's growth and brand. Google benefitted from the slingshot by leveraging content fueled by massive web portals like Yahoo and MSN.

The Symbiote

The symbiotic startup fuels it's early growth by leveraging another rapidly growing network, or a well established business.

New businesses that grow out of a big company are spin offs that maintain a mutually beneficial relationship with the parent organization, but for any number of reasons require their own business identity. This is the historic symbiotic business relationship.

The rise of social networks which saturate the globe in months or years instead of decades has opened the door to specialized startups. The symbiote provides custom content and community to the host in exchange for vital early life marketing and connectivity. Three potent examples of startups executing symbiotic relationships are Zynga with Facebook as a host, Stocktwits with Twitter as a host, and Github with Engine Yard literally as a host.

The Whip

Imagine a specific resource expended by your startup accelerated to be 100 times more efficient. Every dollar and man-hour in, creates an output that is orders of magnitude beyond more well rounded or diverse businesses. Execution of the Whip requires all of a startups limited resources, and expends every ounce of energy, from an incredible team to perform one ultra specific task faster or better than anyone else. Anything that is optional is ignored or removed. The cost is that this startup is incapable of doing anything else (no pivots).

This is what the Whip can provide for your startup but it requires unbelievable focus and acceptance of large risk. What if your startup's one thing isn't as valuable as predicted? The destination of the whip is determined at the moment it is swung. The Whip should only be used after product market fit is assured*.

The Phoenix

Big companies self optimize to extract all the profit they can out of a market cycle, but are often unable to transition to new markets. Their complicated structure proves fragile in the face of the winds of time.

Just when a huge market and its massive corporations crumble into a heap of smoldering ashes, a new spark appears. This spark finds latent value in the remnants of large businesses that failed to transition. A handful of employees apply critical knowledge and skills mastered within the burning titan to an emerging market need^. This small project then leads to a bright new startup, the Phoenix flies again.

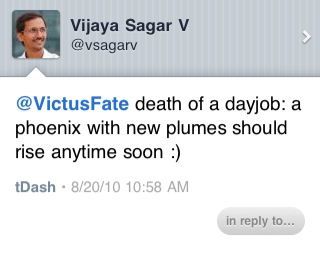

Special thanks to my my friend Vijaya Sagar the Fifth cofounder of Shufflr and Althea Systems for his continued enthusiasm and planting the phoenix reference in my mind:

Notes:

*= It may be advantageous to have hyper focused market businesses working separately from Whip like execution startups. Do any venture or angel firms work like this?

^= Or a shrewd investor buys capital goods or IP for pennies on the dollar and repurposes them. Alternatively, one customer is willing to pay a premium for the now defunct products of the old company. Who builds parts and repairs SGIs?