This is my first iteration on startup location and how it interacts with the goal of profitability for a nascent business. The original startup location* post was three overlapping spheres with no common area to all topics. I began with a fuzzy image of the relationship between location, cost and conditional probability of success.

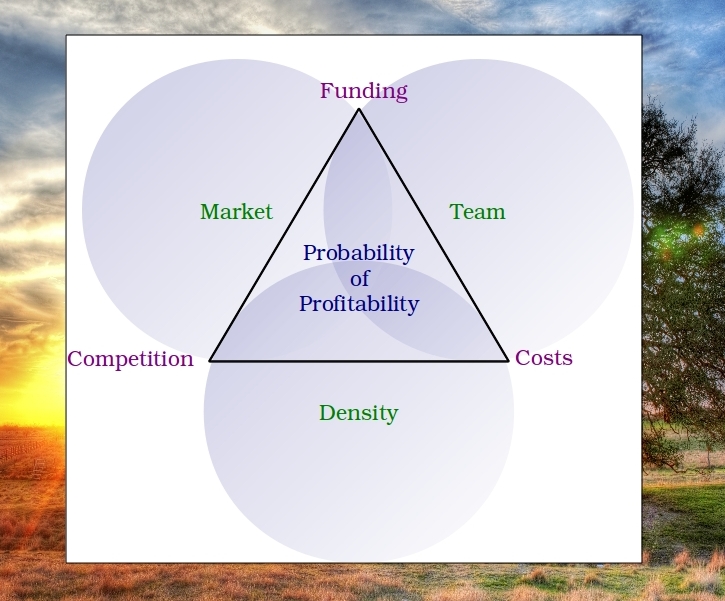

In the the image above, profitability is integral to the survival of any startup and is influenced first and foremost by the team, then the market, and finally the density of surrounding startup culture. In startup rich areas such as Silicon Valley, Boulder or New York, growing a strong team has increased costs and high value markets bring heavy competition. A strong founding team with healthy market prospects yields a much greater likelihood for early funding. Funding and location are correlated. Early valuations are driven by investor deal competition, successful founder track records, social proof and market traction.

The density of startup culture can benefit a founding team. The likelihood of partnering up with at least one cofounder who shares your vision and zeal is statistically greater in the high energy plasma of startup hubs. Cohabitation fosters closely working alongside your founder. This alleviates communication difficulties, promotes rapid iteration and vital feedback.

Notes:

*= my initial startup location thoughts