Cross Platform App Strategies Elevate Beyond Cannibalistic Platforms

A significant portion of new media and tech companies are founded on platform access to both people and their data. Early on in the startup's existence developers are encouraged to build on top of an API by minimizing barriers to entry and granting a broad range of access. Over time the walls go up and access is reigned in. Ecosystem contributors scout out high value services within a particular platform's broader market, and as is often the case in immature markets, the platform devours its most promising offspring. I compared two simple categories of business trajectories in March last year.

Seize Opportunities

One strategy is to zero in on an existing market, and capitalize on opportunities that aren’t being addressed by other services. Deep market understanding and execution are key areas that foster this form of startup growth. This business structure is commonly founded on top of existing platforms, as the goal is not to create but to capture. The capture philosophy takes advantage of previous market creation, and leverages the overall sector growth to feed the startup.

Build New Markets

Another strategy for a bold startup is to create an entirely novel market. The risks are greater (unknown demand), but the rewards of creating and leading a new market are compelling. The new market strategy may be a realignment of an existing unfeasible product or service, or it may be a completely new technology or invention. These types of startups are platform builders. The platform benefits greatly by inspiring outside users and developers to utilize it. Generally a share of the revenue is split between platform creator and each service built on it. Lower costs and rich functionality prompt more rapid adoption and growth. This translates into spectacular opportunities for the platform startup.

Case Study: Twitter

In framing the relationship between app developers and Twitter, I'd like to leverage the thoughts of Chris Dixon who discussed his view of Twitter's relationship with it's developers in 2009:

At some point, significant (non-VC) money will enter the Twitter ecosystem. I have no idea whether this is will be by charging consumers, charging businesses users, search advertising, sponsored tweets, licensing the twitter data feed, data from URL shorteners, or something else. But history suggests that where there is so much user engagement, dollars follow.

For the sake of argument, let’s suppose Twitter’s eventual dominant business model is putting ads by search results. Who gets the revenue when a user is searching on a 3rd party Twitter client? Even if Twitter gets a portion of revenue from ads on 3rd party apps, there will always be an incentive for them to create their own client app, or to “commodotize” the client app by, say, promoting an open source version.

And extended the brief analysis in 2010:

Twitter’s moves this week were particular interesting. A lot of third-party developers were unhappy. I think this is mainly a result of Twitter having sent mixed signals over the past few years. Twitter’s move into complementary areas was entirely predictable – it happens with every platform provider. The real problem is that somehow Twitter had convinced the world they were going to “let a thousand flowers bloom” – as if they were a non-profit out to save the world, or that they would invent some fantastic new business model that didn’t encroach on third-party developers. This week Twitter finally started acting like what it is: a well-financed company run by smart capitalists.

This mixed signaling has been exacerbated by the fact that Twitter has yet to figure out a business model (they sold data to Microsoft & Google but this is likely just one-time R&D purchases). Maybe Twitter thinks they know what their business model is and maybe they’ll even announce it soon. But whatever they think or announce will only truly be their business model when and if it delivers on their multi-billion dollar aspirations. It will likely be at least a year or two before that happens.

Normally, when third parties try to predict whether their products will be subsumed by a platform, the question boils down to whether their products will be strategic to the platform. When the platform has an established business model, this analysis is fairly straightforward (for example, here is my strategic analysis of Google’s platform). If you make games for the iPhone, you are pretty certain Apple will take their 30% cut and leave you alone. Similarly, if you are a content website relying on SEO and Google Adsense you can be pretty confident Google will leave you alone. Until Twitter has a successful business model, they can’t have a consistent strategy and third parties should expect erratic behavior and even complete and sudden shifts in strategy.

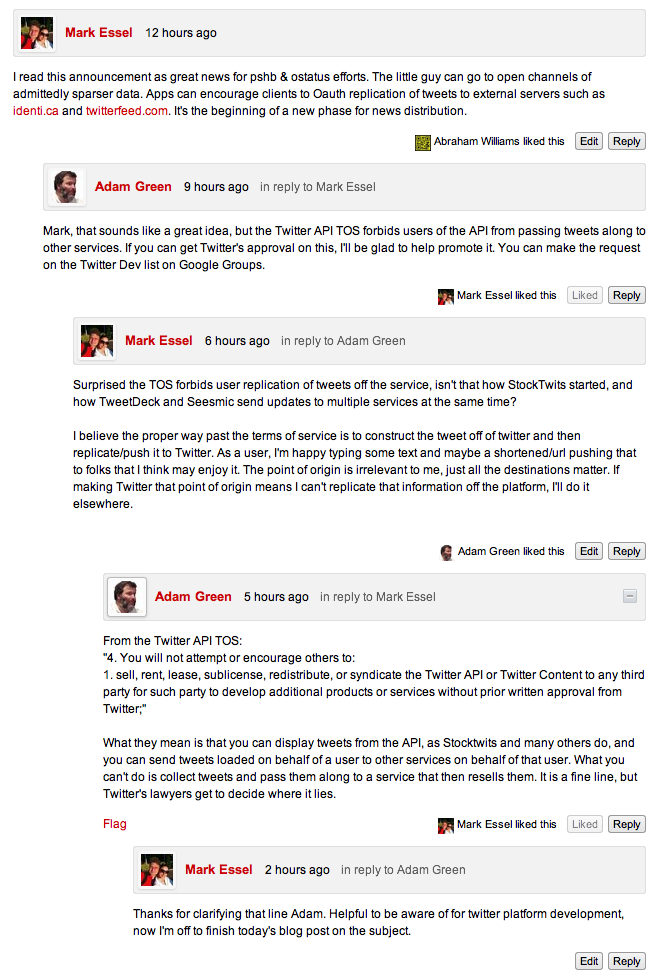

With TweetDeck's recent acquisition by Bill Gross/UberMedia, and Seesmic's strategic move (CEO Loic Le Meur shares some of his thinking) towards hybrid consumer/enterprise social networking, we're witnessing major microblogging applications continue their migration to more defendable and resilient positions. I mentioned in a comment on ReadWriteWeb that this landscape and environmental shift may precede a developer migration towards more open, but smaller news sources and Adam Green was generous enough to add feedback on Twitter's Terms of Service.

Update: I should note my use of the term WIN in the title is an Andy Swan-ism such as classic comments he leaves in places like AVC.com or status updates like this:

[blackbirdpie url="http://twitter.com/AndySwan/status/35499112803598336"]

Related Posts:

These are just a few of my thoughts on startup strategies and how they relate to platforms for the social web.

Startup Strategies:

- Minimalist Design, which APIs/platforms

- Attention Jiu Jitsu

- Startup Weapons: The Slingshot, the Symbiote, the Whip and the Phoenix

- How Device Apps will Merge with the Web

Thoughts on ideal social web protocol/service features:

- The human social interface, why I love the Net

- The prize making sense out of millions of voices

- Data Silos or a Social Web Pattern

- Matricide, SocNets Plan to Strangle the Web which gave them Life

- Personal Social Gardens that live in the browser

- Open Web Protocols

- Rising Tides & Network Economies

- Social Web Neutrality

- Open Social Media of the People, by the People, for the People

- The Democracy of Attention, an Economy of Minds